Industry News: November 2002

By Robert M. Hausman

ATF: Machine Gun Production Gained In 2000

Firearm production in most categories declined during 2000, from year before figures, but machine gun production more than doubled. A total of 47,400 machine guns were manufactured in the U.S. during 2000, a significant gain over the 22,490 produced during 1999, according to statistics compiled by the Bureau of Alcohol, Tobacco & Firearms.

Another bright spot was rifle manufacturing, which rose slightly. Some 962,901 pistols were produced by U.S. manufacturers during 2000, compared to 995,446 the year before. Revolver production totaled 318,960 during 2000, versus 335,784 the year before. Shotgun manufacturers produced 898,442 pieces in 2000 in comparison to 1,106,995 in 1999. Rifle production eased up to 1,583,042 in 2000, slightly over the 1,569,685 made in 1999. By caliber, year 2000 pistol production broke down as follows: 184,577 pistols were made in calibers up to and including .22; some 23,198 were produced in calibers up to .25; a total of 60,527 were made in up to .32 caliber; 108,523 in up to .380; a total of 277,176 in up to 9mm and 308,900 in calibers up to .50.

The corresponding pistol figures for 1999 were: 229,852 in up to .22 caliber; some 24,393 in up to .25 cal.; a total of 52,632 up to .32 cal.; a total of 81,881 up to .380; a sum total of 270,298 up to 9mm; and, 336,390 in up to .50 caliber.

While total pistol production for the year was down, some caliber categories saw growth. These included .32, .380, and 9mm. Note: ATF groups pistol production into categories that include more than one caliber. For example, the up to .50 caliber category includes handguns produced in such calibers as .40 S&W, .41 and .44 Magnum, .44 Special, .45 ACP, and others.

The export market was not favorable in 2000 as exports, with the exception of some NFA weapons, were down. A total of 28,636 pistols were exported during 2000, along with 48,130 revolvers, 49,642 rifles, and 35,087 shotguns. The corresponding export totals for 1999 were: 34,663 pistols, 48,616 revolvers, 65,669 rifles, and 67,342 shotguns.

Some 11,719 machine guns were exported in 2000, compared to 22,255 in 1999. The export total for all other NFA arms increased to 4,114 in 2000 from 2,955 in 1999. A total of 11,132 miscellaneous firearms were exported in 2000, compared to 4,028 in 1999.

The top pistol producer during 2000 was Sturm, Ruger & Co. with 233,598 examples. Bryco Arms came in at second place with 116,664. Beretta U.S.A. came in third with 90,532 and Smith & Wesson was fourth with 90,406.

Sturm Ruger led rifle production with 309,017. Marlin produced 287,418 and Remington made 250,249 rifles.

Remington was the top shotgun producer in 2000 with production of 355,178, compared to 274,838 by Mossberg/Maverick and 162,706 by H&R 1871/NEF.

NRA Show Successful

The National Rifle Association’s Annual Meetings & Exhibits held April 26 - 28, at the Reno, Nevada Convention Center were highly successful with a total visitor attendance count of some 42,000 - a figure well above the 35,000 visitors show organizers had anticipated for the relatively sparsely populated northern Nevada locale.

While the attendance made exhibitors happy, as it was often difficult to navigate the aisles due to the throngs of enthusiastic consumers looking over the latest firearms and other outdoor gear, this was not the busiest ever NRA show. The attendance record-setting show was held just two years ago in Charlotte, North Carolina when some 55,000 visitors were recorded.

Though the show was held in Nevada, many of the visitors were California residents which provoked some concern from exhibitors of handguns and military-style firearms, some of which could not be sold in California due to that state’s onerous handgun testing regulations and a law banning so-called “assault weapons.” However, many of the attending Nevada residents indicated they were former Californians who had left the “Golden State” due to its repressive gun laws.

In a move that took many by surprise, James Jay Baker, announced he was leaving the position of executive director of the NRA’s lobbying arm, the Institute for Legislative Action, during an NRA Board of Directors meeting during the show.

In response, NRA executive vice president, Wayne LaPierre named Chris Cox, as Baker’s replacement. The appointment took effect immediately.

“Baker will be changing his relationship with the NRA and returning to private practice,” LaPierre said. “I will miss Jim’s leadership, tough legislative skills and most of all, the partnership we have enjoyed for these many years working together.” Baker, an attorney, will continue to work with the NRA as a consultant.

A decade-long veteran of Capitol Hill, Cox is well regarded by both Democrats and Republicans. He is an avid hunter and shooting sports enthusiast. Prior to joining the NRA, Cox worked as a legislative aide to Congressman John Tanner of Tennessee. “The NRA Board of Directors and I, have full confidence in Cox’ ability to tackle all challenges that will come in our direction. Cox has been an integral part of our federal government relations. He is politically astute and results oriented in his management approach. He has what it takes to be the NRA’s chief lobbyist,” LaPierre emphasized.

Ruger, S&W Have Increased Sales

First quarter 2002 net sales of $48.4 million, compared to $43.9 million in the first quarter of 2001, are reported by Sturm, Ruger & Co. First quarter net income of $4.5 million or 17 cents per share compared to $4.1 million or 15 cents per share in the first quarter of 2001, was achieved as well.

Chairman William B. Ruger, Jr. commented, “After a challenging year, the first quarter of 2002 offers encouragement as total firearms shipments improved 22% from the prior year. Shipments of certain models of our .22 caliber rifles and total pistol shipments increased from the prior year by over 90% and 50%, respectively. The new product offerings introduced at the SHOT Show, most notably the new Ruger 77/17 Bolt Action Rifle chambered for the exciting new high velocity .17 HMR cartridge, have also been received with enthusiastic demand.”

Looking at the balance sheet, Sturm Ruger’s firearms sales came to $42,729,000 (or 88.2% of sales) in the first quarter of 2002 compared to $35,837,000 (81.7% of sales) in the first quarter of 2001. Castings sales totaled $5,711,000 (11.8% of sales) during 2002’s first three months versus $8,027,000 (or 18.3% of sales) during the corresponding period the year before. Gross profit came to $12,280,000 (25.4%) during this year’s first quarter, in comparison to a gross profit of $11,967,000 (27.3%) for the first quarter of last year. There were 26,911 basic and 26,997 diluted shares outstanding during the three months ended March 31, 2002, compared to 26,911 basic and 26,914 diluted average shares outstanding for the quarter ended March 31, 2001.

Good news continued to come on the legal front during the first quarter.

On Jan. 11th, the U.S. Third Circuit Court of Appeals affirmed the District Court’s order granting dismissal of all claims in the Philadelphia city case and affirmed its prior ruling dismissing the Camden County case. The Georgia Appellate Court dismissed the Atlanta suit on Feb. 13th. On March 28, the city of Boston’s lawsuit was voluntarily dismissed with prejudice following a lengthy discovery phase.

Following is a chronology of some of the important events related to the municipal litigation against the industry as compiled by the Hunting & Shooting Sports Heritage Fund:

- August 2000 - Industry wins first appellate court decision with the upholding of the Oct. 1999 dismissal of Cincinnati’s lawsuit by the Ohio Court of Appeals.

- Sept. 2000 - Judge dismisses Chicago’s lawsuit.

- Dec. 2000 - Camden County’s lawsuit is dismissed as is the City of Philadelphia’s suit.

- Jan. 2001 - Industry suspends HUD suit. City of Gary’s suit ruled unconstitutional.

- Feb. 2001 - Miami-Dade’s suit is rejected by Florida Appellate Court.

- March 2001- City of Gary’s suit dismissed a second time.

- April 2001- City of New Orleans suit (the first-of-its- kind) was dismissed by the Louisiana Supreme Court.

- Aug. 2001 - ‘Hamilton Decision’ reversed by U.S. Court of Appeals.

- Oct. 2001 - CT Supreme Court upholds dismissal of City of Bridgeport’s suit and the U.S. Supreme Court declined to revive the City of New Orleans’ suit. Also, a U.S. Appeals court finds the Second Amendment guarantees an individual right to keep and bear arms. To top the month off, the Florida Supreme Court rejects the Miami-Dade gun suit.

- Nov. 2001- A federal appeals court rejects the Camden County gun suit.

- February 2002 - The Georgia Court of Appeals dismisses the City of Atlanta’s suit.

- March 2002 - The City of Boston abandons its lawsuit.

A net income for the fourth fiscal quarter ended April 30, 2002 of $2.4 million, a 100% increase over the net income of $1.2 million for the third quarter, is reported by Smith & Wesson Holding Corp. The net income of $2.4 million was achieved on revenues of $23.8 million, an increase of 10% over the sales of $21.6 million achieved in the firm’s third quarter ended Jan. 31, 2002.

The company reported earnings of 11 cents per basic share outstanding and 8 cents per diluted share outstanding for the quarter ended April 30, 2002 versus earnings of 7 cents per basic share outstanding and 4 cents per diluted share outstanding for the third quarter.

EBITDA (Revenue minus Expenses, excluding tax, interest, depreciation and amortization) for the fourth quarter was $3.8 million compared to the third quarter EBITDA of $3.1 million, an increase of about 22 %. The increases, according to S&W, are attributable to marketing efforts resulting in improved sales, management’s efforts to consistently monitor and cut costs equating to better profit margins and a renewed positive sentiment toward S&W as it was returned to U.S. ownership.

“Our net income better reflects the cost cuts put in place by new management since acquiring the company last May,” commented Mitchell Saltz, chairman and ceo. “The steady trend of quarterly improvement throughout our fiscal year clearly demonstrates the effectiveness of our business plan.”

In other financial news, Smith & Wesson Holding Corp. recently announced it had executed a $15 million loan agreement with BankNorth and has retired $15 million in short-term debt related to its acquisition of Smith & Wesson Corp. last year, with the funds. The company retired a short-term $10 million note owed to Tomkins PLC and a $5 million note to Colton Melby, a member of the board of directors. The 12-year note to BankNorth carries an interest rate of 5.85% and is interest only for two years and straight amortization over the remaining 10 years.

Melby has chosen to reinvest the entire $5 million into equity. He has exercised his warrants for about $2.8 million and has reinvested the remaining $2.2 million through a private investment in common stock of the company.

“This transaction allows us to fulfill the balance of our short-term purchase requirement to Tomkins PLC by retiring the short-term note ahead of schedule and replacing it with a long-term note at a favorable interest rate, while adding $5 million in shareholder equity,” said chairman Saltz.

S&W Corp. has signed an exclusive worldwide agreement with AngioLax, to market and distribute the Tactical Vision product line developed and manufactured by AngioLaz. The products involved are unique new inspection and surveillance tools designed primarily for law enforcement and military applications. AngioLaz is a sister-company of Vermed Inc., a maker of medical equipment.

The Tactical Vision products are small, pole-mounted video cameras that have their own light source and integrated video monitor that allow the user to safely view areas otherwise inaccessible. Among the applications is the ability to look underneath vehicles, up or down staircases and into second floor locations from the ground. The non-conductive telescoping pole can be easily user adjusted from 57 inches to 12 feet. It is available with either an integral Infrared or LED light source.

“S&W’s brand name, reputation and global distribution network make them the ideal company to market and sell the Tactical Vision product line,” said Rich Kalich, AngioLaz’ president and COO. “We look forward to a long and growing relationship.”

The author publishes two of the small arms industry’s most widely read trade newsletters. The International Firearms Trade covers the world firearms scene, and The New Firearms Business covers the domestic market. Visit www.FirearmsGroup.com. He may be reached at: FirearmsB@aol.com.

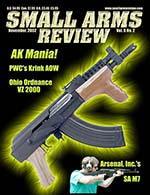

This article first appeared in Small Arms Review V6N2 (November 2002) |

| SUBSCRIBER COMMENT AREA |

Comments have not been generated for this article.